March 28, 2024

Table of Contents

Key takeaways

- The opportunity to buy low on tech includes private equity, with the current environment - particularly in software - conducive to public-to-private transactions. We favor seasoned operators who have extracted value through market cycles.

- We see exciting opportunities in artificial intelligence (AI) - an area in which we think private markets have an edge - but selectively. Picking through the noise requires investing with managers that can separate hype from a sustainable business model.

- In private credit, we see opportunity at the smaller end of the market with specialist lenders. While risk may be slightly higher on the company level, spreads are elevated, meaning less need for leverage and the ability to include tighter covenants.

Investment ideas

Related to this article

2023 was a classically “macro” year. An inflation impulse led to a Fed impulse, which led to several banks breaking, which led to a pullback in the availability of capital. This naturally affected markets, with tech and finance coming under particular pressure.

This year in public markets, we are watching how the expectations of the Fed match with their actions - and a potential disappointment for doves given a relatively robust economic situation. Also on our radar: how equities will perform relative to elevated earnings expectations, and whether or not equities and fixed income will provide any protection as their correlation drifts into positive territory. These three areas will certainly have a bearing on the opportunities available in private markets, and we will continue to update you on how this is shaping the private investment landscape.

Regardless, we see clear trends on the private side that potentially make 2024 a unique period for investment, particularly in growth-focused parts of private markets.

A falling tide…strands some boats

Rising tides lift all boats. Rising costs of capital by and large do the opposite.

Regardless of perhaps overly-aggressive expectations of Fed rate cuts, rates are higher than they have been since the global financial crisis, and standards set by creditors have tightened considerably.

This makes selectivity key: the best ideas can easily exceed a mid-teens required rate of return, while investors benefit from a more attractive entry point. But at the same time, creative destruction will happen faster, with more startups failing to raise follow-on rounds, borrowers unable to meet loan obligations, and middle-market firms falling to grow EBITDA as fast as debt. For winners, funding will get easier and easier as proof-points accrue. For losers, runways will be much shorter.

This is likely good for the world, at least in small doses. Hopefully we will see fewer FTXs and WeWorks as the prudence of higher costs of capital sets in. Based on our research and conversations with fund managers across private markets, there is no shortage of good ideas. And very good ideas are still able to attract capital.

Below we describe three key areas that seem ripe for selective investors to benefit from the tailwinds (and headwinds) facing capital markets.

1. Active private equity that can buy low in technology

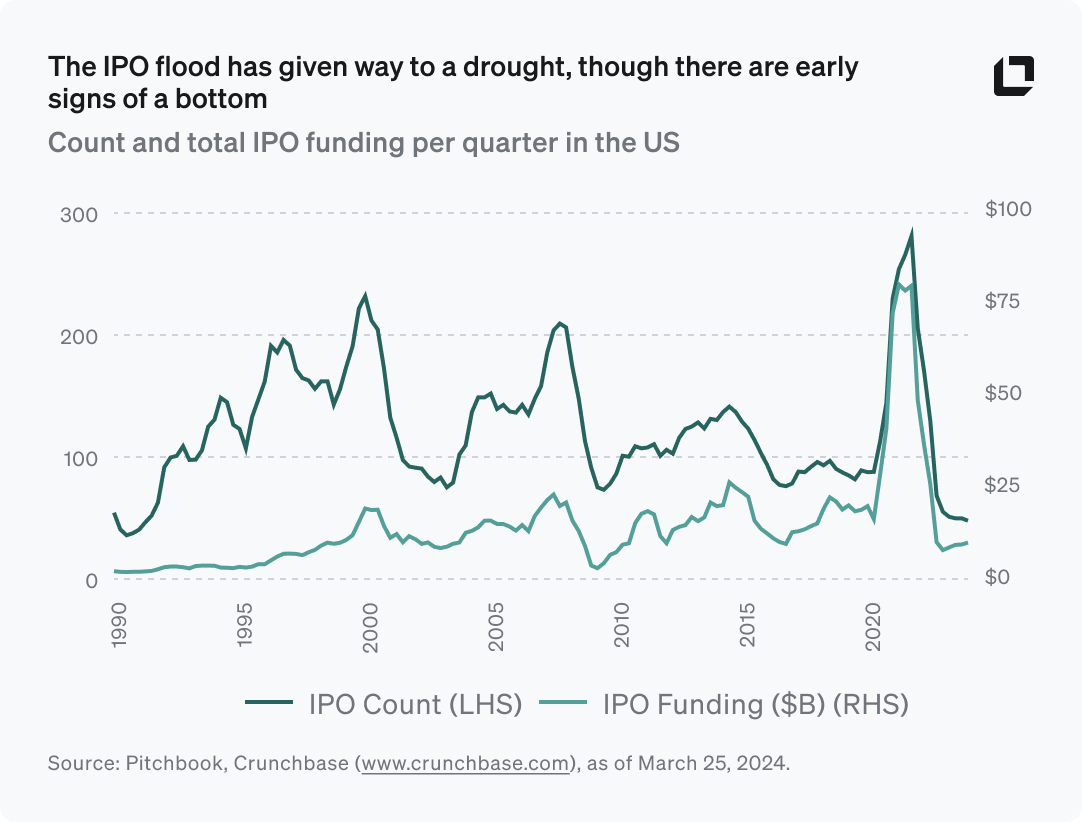

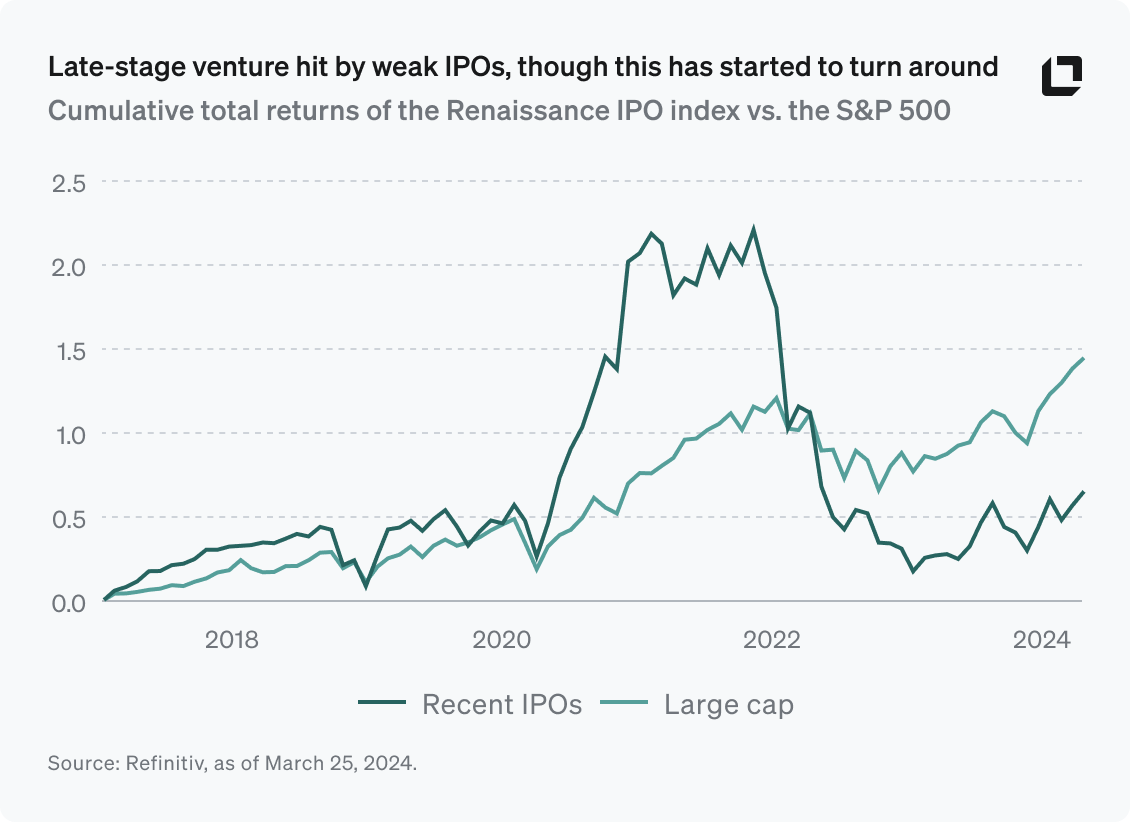

While there have been some high-profile down-rounds, much of the pain in the technology sector has shown up in much slower deal activity and the weaker post-IPO performance of software companies. Deal activity has hit multi-decade lows, and total funding has fallen 80-90% (see first chart)1. While this has been a painful period for late-stage venture (see second chart), one that looks set to continue as valuations reset, this creates opportunity for private equity investors.

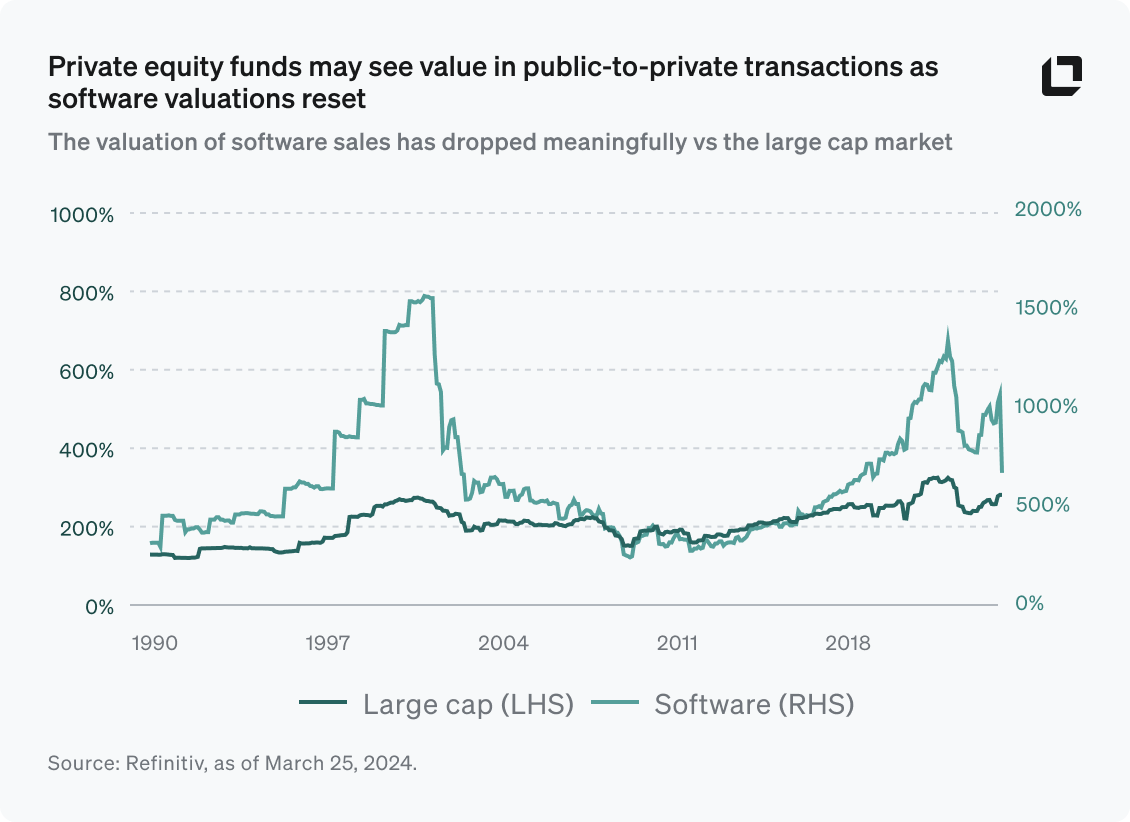

Valuations of public software companies are also coming back down to earth, after being stretched for seven years or so (see chart). While software should generally trade at a higher enterprise value-to-sales (EV/sales) ratio than traditional industries, the 5x premium over large-cap firms seen in 2021 was hard to explain relative to the fundamentals of margins and growth.

While sales activity has remained relatively strong, EVs have been flat-to-down in recent quarters outside of a few of the largest names. This makes private equity-backed public-to private conversions for software companies look attractive in many areas, even at higher borrowing rates.

Again, selectivity will be key for these managers, and we favor seasoned operators who have extracted value from software companies through market cycles, versus performance solely built during the 2010-2021 bull market in technology.

2. Intelligent investing in Venture/AI

As we have written before, we do not see a bubble in AI, but the market is certainly immature. Picking through the current noise requires investing with managers that can separate hype from a sustainable business model.

Much of the AI infrastructure is yet to be built, just as cloud infrastructure and developer tools took a decade to mature in the 2010s. Valuations for certain consumer-facing generative tools are frothy, but those for deep tech, infrastructure, developer tools, and the hardware supporting AI are more moderate, potentially making this an attractive vintage in seed and series A venture.

Some of the most interesting use cases for AI can also directly address some of the big potential headwinds for the global economy, for example, defense and cybersecurity. Security is often overlooked when the AI innovation wave is discussed.

AI and the opportunity in cybersecurity

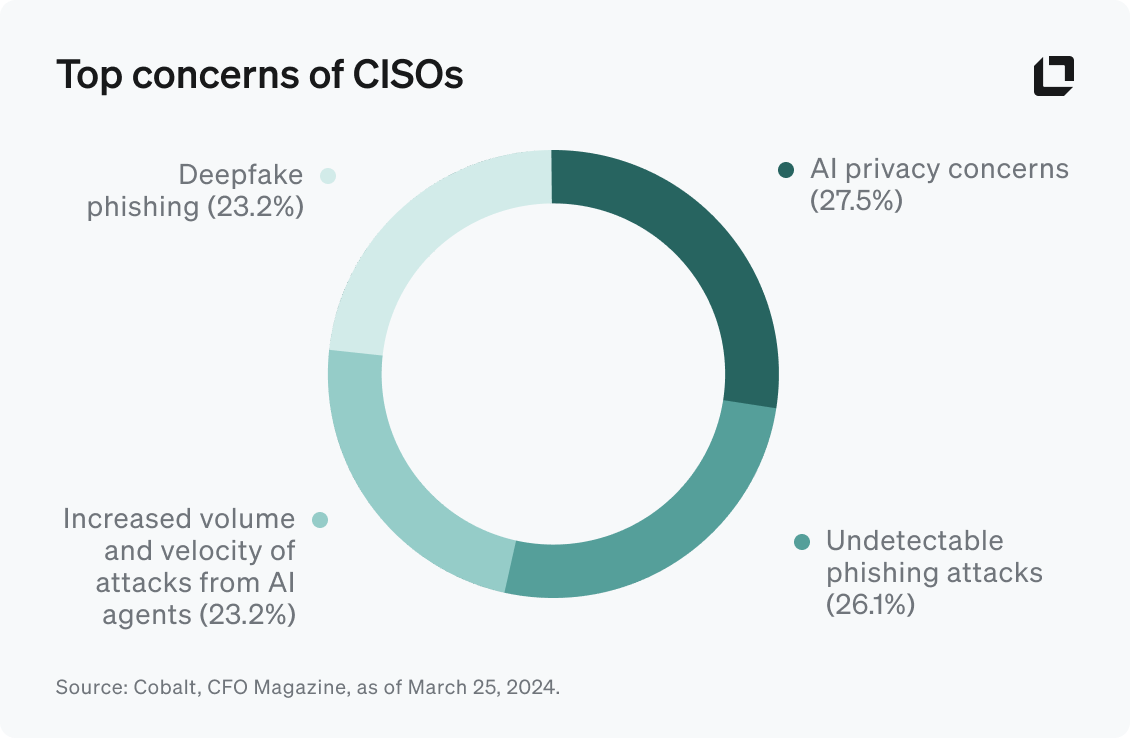

Chief Information Security Officers (CISOs) are increasingly (and rightly) worried about:

Data protection and security when training AI models

Identity and verification in the world of AI deepfakes

Managing networks where autonomous AI agents could be working alongside humans

The rise of AI-powered attacks by state-sponsored and independent “hacktivist” groups taking advantage of increased uncertainty across the world

In a more optimistic light, founders are rising to the challenge of securing the future by building companies in a sector that thrives on responding to innovation megacycles like AI. In every innovation wave, from PCs to mobile to cloud, a new crop of security companies emerge to make the adoption of new technologies more secure, while using those new technologies themselves to protect their companies from the ceaseless cycle of more sophisticated attacks.

And with 80% of CISOs increasing their security spend in 2024 due to AI threats, this will allow for new companies to form and potentially thrive.

To get access to this new innovation cycle in security, you generally have to go early and partner with a manager that knows the space deeply with a track record in security. Only a few security companies in each megacycle typically go public - such as Palo Alto Networks and Crowdstrike from the cloud era of the 2010s - making manager selection crucial. Exits are not limited by IPO prospects, as even in the gloomy M&A markets of today, big transactions suggest that the top public security companies will continue to partner with startups to grow their platforms to protect against new attacks.

It is clear that a new generation of cyber defense must be built, as tools for malicious actors evolve in parallel, presenting opportunities for VCs that can identify the right sub-sectors and founders.

3. Finding niches in private credit

Whenever people say anything is in a golden age, investors should be cautious (and perhaps remember what happened to King Midas).

While the rising cost of capital and banks pulling back on lending has supported private credit origination, investors still must be selective. Money has been pouring into semi-liquid business development company (BDC) strategies, which purchase illiquid underlyings. Because of the nature of these structures, capital must be put to work quickly, making these funds “forced lenders”. To maximize efficiency, they typically must focus on large deals so the balance sheet can be fully invested in the shortest amount of time. This does not allow as much room for careful selection as a drawdown fund structure.

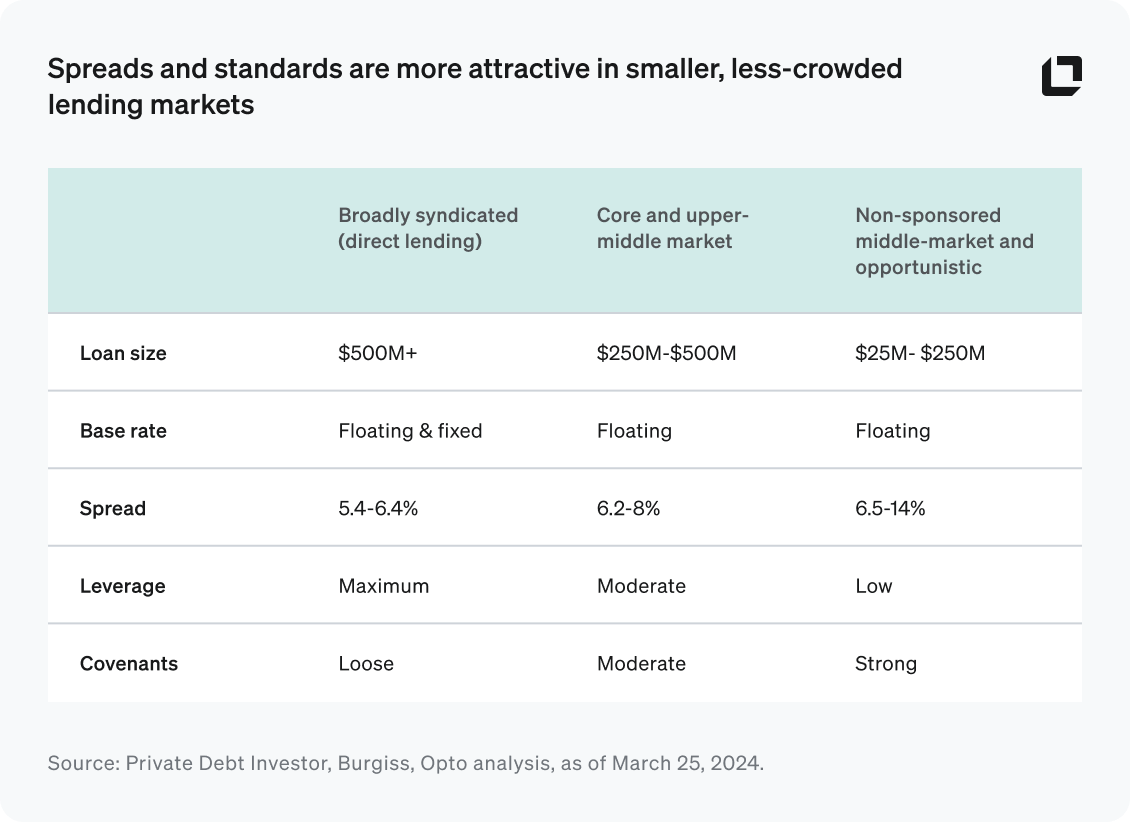

At the larger, direct lending end of the market, we see relatively tight spreads, high leverage levels to compensate for this, and loose covenants, all driven by fierce competition.

At the smaller end of the market, the story is very different. Spreads are elevated, meaning less need for leverage and the ability to include tighter covenants (see table below). Smaller loans means smaller managers, which we favor in this market, specifically lenders that specialize in their niches and have experience and comfort working with (technically) slightly higher-risk companies.

We say technically, because lower debt levels mitigate some of the risk of lending to smaller companies, while large, syndicated borrowers tend to have much higher existing leverage levels.

Unlike in public corporate finance, where a “maturity wall” is certainly a shorter-term risk, only 10-15% of private direct loans mature in the next two years. This reduces some of the risk of high leverage levels, though companies are still exposed to shocks to sales, margins, or cost of capital that could impair their ability to meet obligations.

We favor a scalpel approach rather than a shotgun one in private credit, with a surgical focus on places where banks have clearly stepped back (but where beliefs in a golden age of private credit have not turned substance into glitter).

To discuss any of these potential opportunities (or any other in the broader private markets universe), get in touch. We love dialog with the RIA community. ICYMI: This is the third of our three outlooks for 2024 and beyond: check out part one (the big picture) and part two (macro drivers).

Endnotes

Crunchbase data from www.crunchbase.com.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

Table of Contents

You may also like

If you found this content valuable, you might also enjoy these:

Jacob Miller and Matthew Rubin emphasize manager selection and incentive alignment in private markets.

2 MIN WATCH

Jacob Miller and Matt Rubin discuss how investors can navigate illiquidity in private markets

2 MIN WATCH

Jacob Miller breaks down three key drivers of past equity returns—and why they may not repeat

3 MIN WATCH