January 30, 2024

Table of Contents

Key takeaways

- Against a backdrop of tighter capital markets and a rising wave of artificial intelligence (AI)-fueled innovation, we see opportunities in niche private credit and several asset classes likely to be able to support the growth of, and benefit from, AI.

- Tighter capital shifts the balance of power towards lenders, which in theory should lead to higher deal quality. In parts of direct lending, competition may be intense, but in more specialized niches the dynamics should create favorable entry points.

- Private capital, particularly early-stage venture, middle-market private equity, and funds investing in the assets powering AI, should offer exposure to both AI innovation and the ripple effects of its deployment, providing interesting opportunities.

Investment ideas

Related to this article

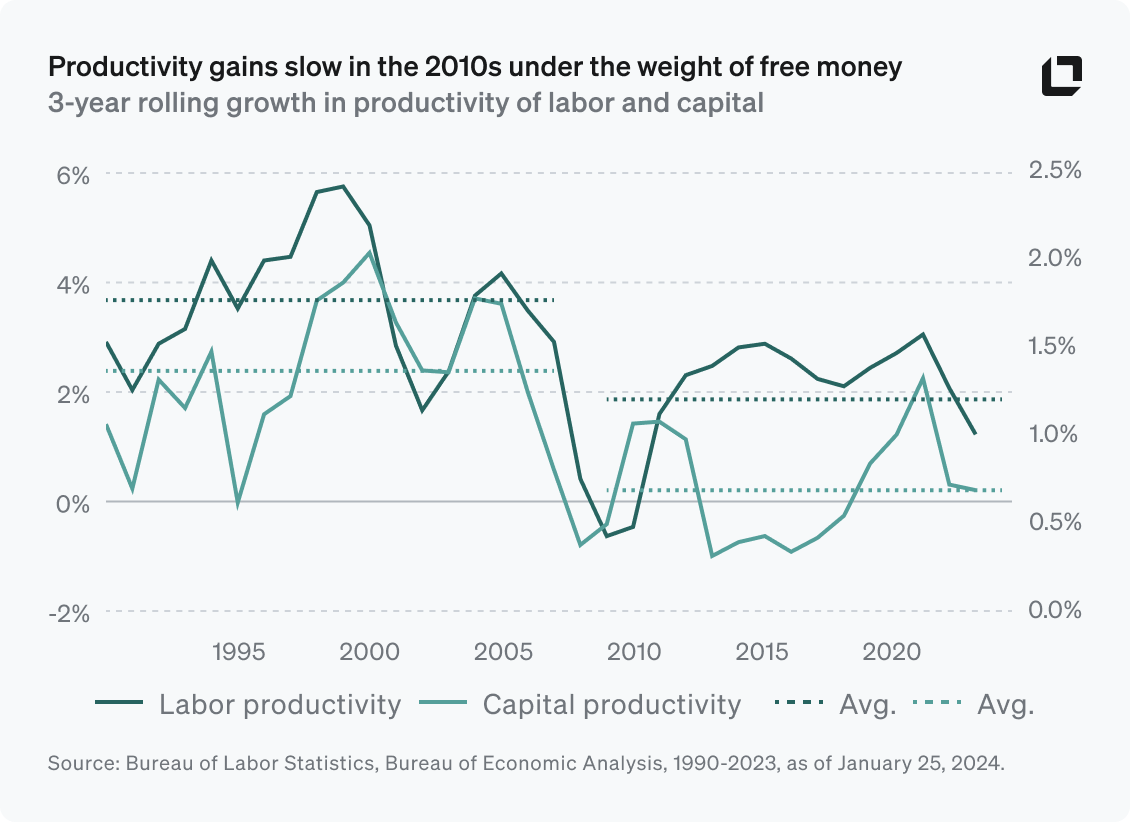

There are two things that are true about the 2010s that seem like they should conflict: it was the best decade ever (in terms of excess return) for the 60/40 portfolio, and was also one of the lowest periods of productivity growth for the US economy in decades (see chart below). What can reasonably explain high returns at the same time as a less-vital economy fueling that growth? Free money.

Whether or not zero percent rates and quantitative easing were warranted - and they almost certainly were at first - a decade of easy policy and borrowing fueled growth. Ideas both good and bad attracted capital, with little room for creative destruction. This inherently lowered the bar for what ideas got funding, reducing productivity growth.

A rising tide lifted all boats. The one-two punch of a global pandemic and inflation - plus its policy response - left a number of those boats stranded.

With the party over, the name of the game is selectivity.

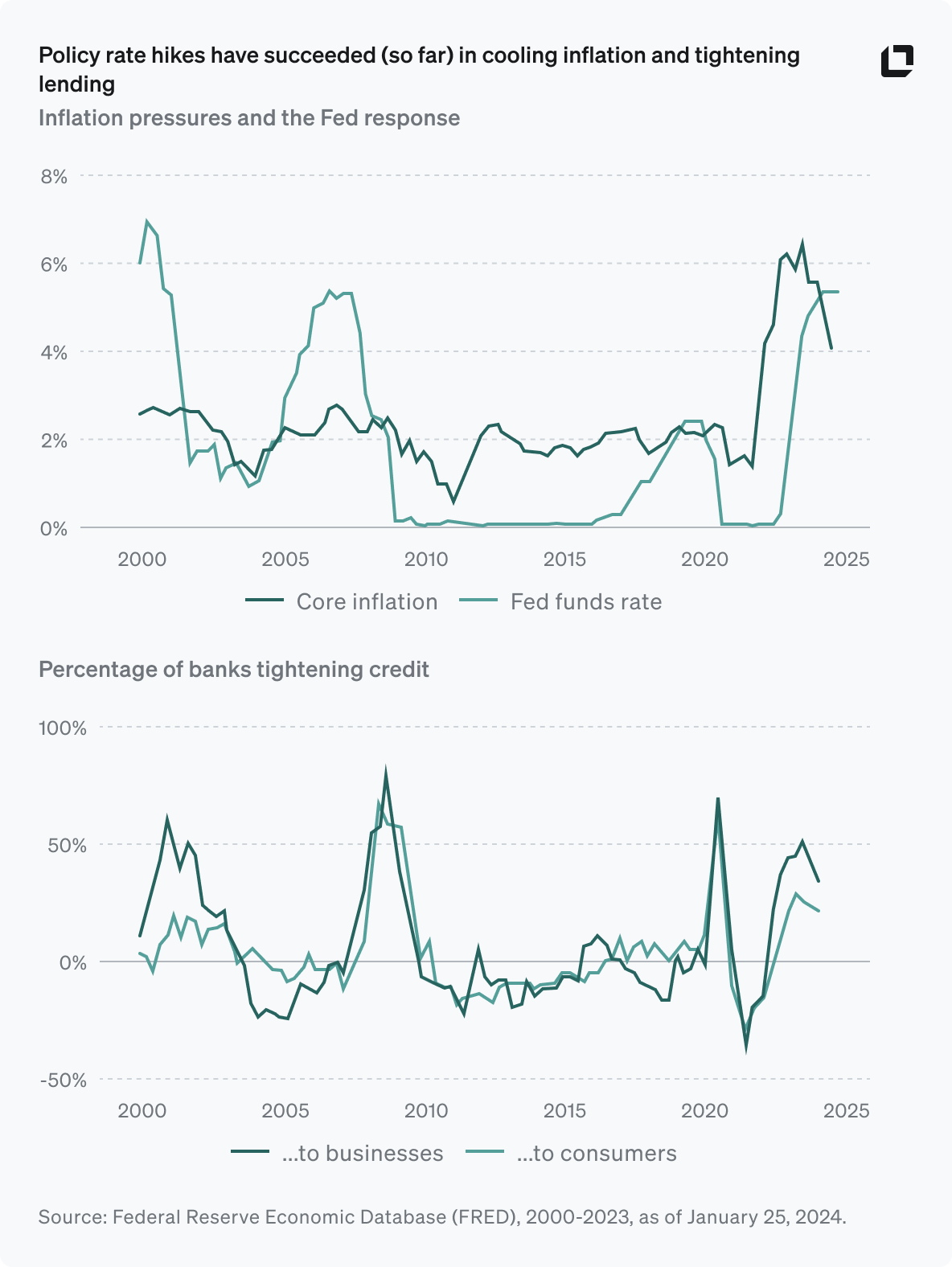

The opportunity in tighter capital

The Fed’s policy rate hikes were a bit late though roughly as expected. While they (so far) seem to be the antidote the inflationary dynamic needed, the rate adjustment caught out many players, including Silicon Valley Bank, First Republic, some regional banks, and much of the growth equity market. This has caused a general pullback in the availability of capital (see charts below), including in private markets.

What does this mean for the investment landscape looking forward?

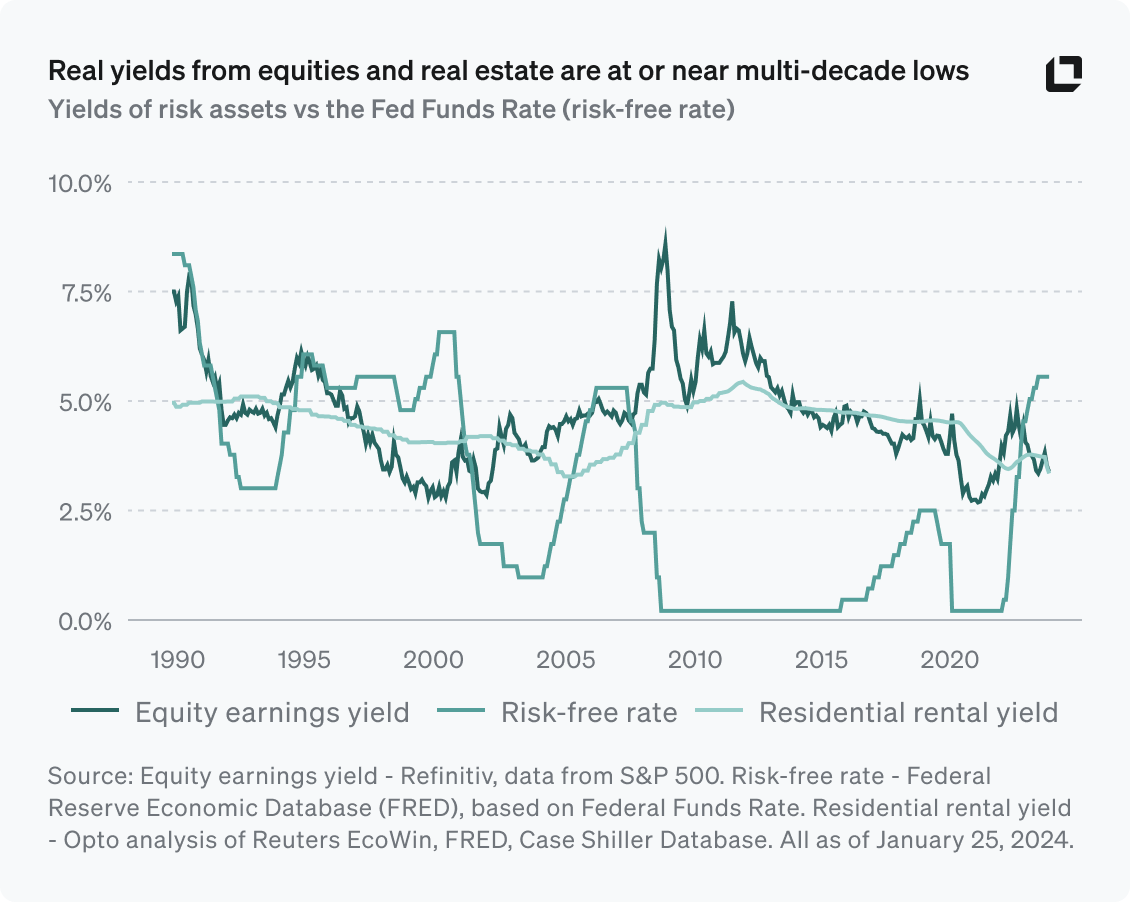

While capital has become more scarce, valuations are still stretched. Equity and residential estate (the two primary mechanisms of saving in the US) still offer yields at or near multi-decade lows (see chart below), making traditional fixed income an attractive alternative. It is therefore reasonable to expect a downward adjustment in equity valuations relative to fixed income. Conversely, this adjustment could be triggered by a decrease in economic activity (and likely a Fed reaction to cut rates), which would likely create downward pressure on earnings. Both scenarios would be painful for investors.

For private markets, tighter capital has shifted the balance of power away from consumers of capital and towards providers, which in theory should lead to higher deal quality and better expected returns.

While this dynamic extends across markets, private credit managers have stepped in where banks have stepped out. In the larger segments of the direct lending space, this dynamic is more muted, with a lot of capital competing for the same deals after an aggressive fundraising period for major players. However, in those spaces that are smaller, more specialized, or require deep experience to underwrite deals, the capital dynamics make 2024 an interesting period for deployment.

The rise of artificial intelligence

While the current dynamics make the nimble parts of private credit interesting, they are also a net headwind for the economy, limiting investment and borrowing. However, the proliferation and upgrading of AI breeds broad, longer-term, secular optimism.

While the hype may sometimes be excessive, AI’s deployment across industries should be considered a true innovation wave, not a bubble. It could have a transformative impact on productivity. While it is still early days, if annual productivity growth rose by even 1.5 percentage points over the next 10 years, the cumulative result would be a US economy more than 20% larger than it would be otherwise. This could compensate for today's high valuations, as well as unlocking more spending and growth for the economy by reducing consumer and corporate debt levels (relative to income).

Of course, the capital dynamics outlined above and the potential for productivity growth from AI will not be felt evenly across the economy, but this combination of uncertainty and opportunity should reward patience. Private vintages deploying in 2024 will have a full market cycle to benefit from the opportunities, but the uncertainties will widen the differential between winners and losers, so investors need to be highly selective.

We see attractive entry points related to AI in a few areas:

Early-stage venture capital, where dynamics currently favor investors and the wellspring of innovation, particularly in AI, has rarely been as interesting.

Middle-market private equity, while not a source of AI innovation, could be one of the most important spaces in which it will be applied. Traditional industries have struggled to increase productivity since an automation wave in the 2000s; AI may spark renewed improvement, and we believe quality private equity managers will be on the bleeding edge of this shift.

The physical assets powering AI will be increasingly key to scale and adoption. It is still too early to determine the shape of infrastructure investment to support the rise of AI, but it is almost certain that the existing build (and potentially overbuild) of cloud infrastructure and supporting real estate will likely be displaced in favor of GPUs and other digital infrastructure. On top of this, the reshoring of semiconductor technology will likely be geared towards AI applications, and leverage AI in building and optimizing chips to match margins and cost structures overseas. Necessity is the mother of invention, and in the short term we expect these real-world challenges to create opportunities for far-sighted investors.

So, what should I watch in 2024?

Both AI and the capital dynamics we have outlined will last longer than a year, and could take even longer to show up in investor portfolios. So, while they are secularly important, there are higher velocity indicators that we would watch closely in 2024:

The market-implied path of rate cuts is aggressive relative to conditions; the Fed doesn’t need to raise or hold rates to disappoint markets, just cut less than expected.

Watch: Equity pricing, leading indicators for consumer and business economic activity, indications that inflation may not be fully behind us.

As implied by the yield chart above, expectations for equity earnings may be too high. Foreign spending (material to large-cap earnings) may contract on weakness in China and Europe. While the US consumer remains strong for now, higher rates will drag on spending growth (spending = income + borrowing). Corporate capital expenditures (Capex) may offset this, but real estate/physical Capex generates the most employment on a relative basis and looks unlikely to provide a significant tailwind.

Watch: Faster-moving trade indicators, consumer confidence, business investment plans, inventory levels.

Diversification has been hard to find in public markets. Inflation and movement in short-term interest rates have recently been the primary drivers of capital markets. These fundamental forces impact equities and bonds in the same way, which means investors have had to look elsewhere for diversification (or accept much higher volatility). Election uncertainty and the aforementioned expectations set for the Fed elevate the probability of stocks and bonds moving together, making diversification and alpha generation more important to portfolio health.

Watch: The correlation between stocks and bonds, growth volatility, Fed forward guidance

This is the first of three articles mapping our expectations for the year ahead. To chat with us about anything we have raised here, please reach out to any of our team, or email advisory-services@optoinvest.com.

Important disclosures

Opto Investment Management, LLC (the “Firm”) is a wholly-owned subsidiary of Opto Investments, Inc. and is an SEC-registered investment advisor. Registration with the SEC does not imply a certain level of skill or training. SEC registration does not mean the SEC has approved of the services of the investment adviser. This website is operated and maintained by Opto Investments, Inc. Certain products described herein and institutional relationships may involve investment advisory services provided by the Firm. This website is presented for financial institutions and investment professionals only and is not intended for individual consumers or retail investors, unless specifically noted. Unless otherwise indicated, commentary on this site reflects the personal opinions, viewpoints and analyses of the author and should not be regarded as a description of services provided by the Firm or its affiliates. The opinions expressed here are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual on any security or advisory service. It is only intended to provide education about the financial industry. The views reflected in the commentary are subject to change at any time without notice. While all information presented, including from external, linked or independent sources, is believed to be reliable, we make no representation or warranty as to accuracy or completeness. We reserve the right to change any part of these materials without notice and assume no obligation to provide updates. Nothing on this site constitutes investment advice, performance data or a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. We disclaim any responsibility for information, services or products found on linked websites. Images and photographs are included for the sole purpose of visually enhancing the website. None of them show current or former clients and should not be construed as an endorsement or testimonial. All investing is subject to risk, including loss of principal. Historical performance is not a guarantee of future performance and clients may experience different results. This information contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of the depicted investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting operations that could cause actual results to differ materially from projected results. See related disclosures at https://www.optoinvest.com/disclaimers.

Table of Contents

You may also like

If you found this content valuable, you might also enjoy these:

Jacob Miller and Matthew Rubin emphasize manager selection and incentive alignment in private markets.

2 MIN WATCH

Jacob Miller and Matt Rubin discuss how investors can navigate illiquidity in private markets

2 MIN WATCH

Jacob Miller breaks down three key drivers of past equity returns—and why they may not repeat

3 MIN WATCH